Fusion Energy Funding Hits Record Highs in 2025

The private fusion energy sector has experienced unprecedented growth in 2025, with funding rounds reaching new heights as investors increasingly back the race toward commercial fusion power. According to recent reports, the fusion industry raised $2.64 billion in private and public funding over the 12 months leading to July 2025, marking a staggering 178% increase from the previous year. This represents the second-highest annual funding total since records began, signaling growing confidence in fusion's commercial viability.

Major Funding Rounds and Investor Confidence

Several high-profile funding rounds have dominated the 2025 landscape. Commonwealth Fusion Systems (CFS), a leading nuclear fusion startup, secured an impressive $863 million Series B2 round, while Helion Energy raised $425 million in Series F funding. Other significant deals included $150 million each for TAE Technologies and Proxima Fusion. 'The investment surge reflects growing belief that fusion is transitioning from scientific research to engineering reality,' noted a senior analyst at the Fusion Industry Association.

Total funding for the 53 fusion companies now stands at $9.766 billion, representing a five-fold increase since 2021. The United States leads with $8.05 billion invested across 42 companies, representing 53% of global funding, while China follows with $5.14 billion across eight companies. 'We're seeing a fundamental shift in how investors view fusion energy,' said Dr. Elena Rodriguez, a fusion researcher at MIT. 'It's no longer seen as a distant dream but as a viable clean energy solution that could reach the grid within our lifetimes.'

Research Milestones Driving Investment

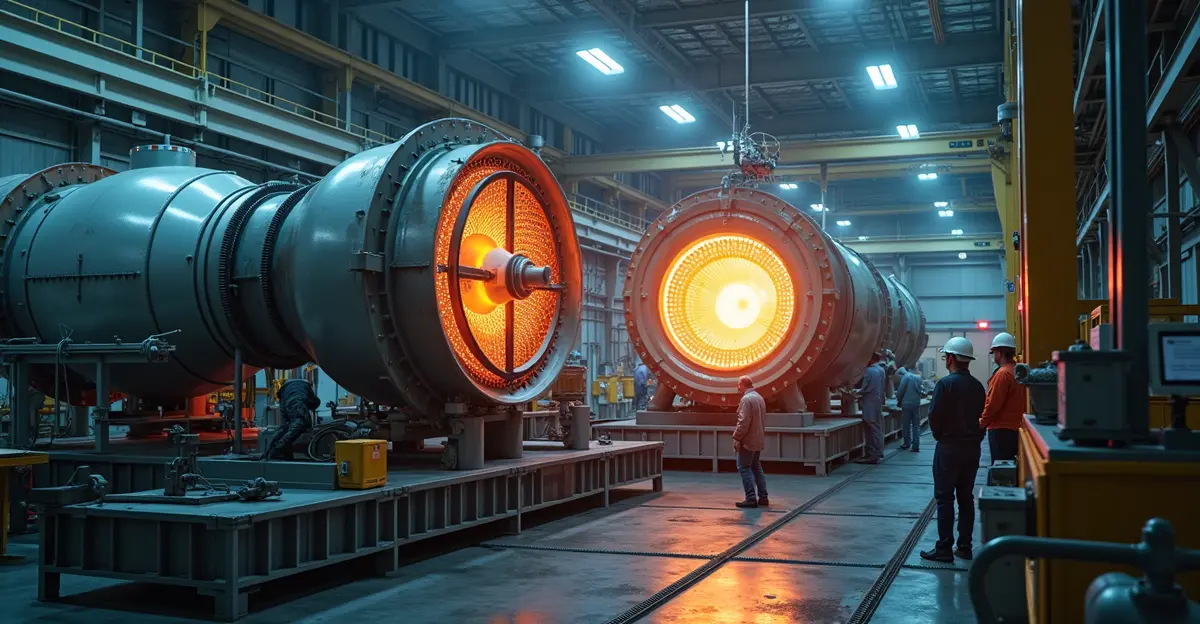

The funding surge comes as fusion research achieves critical milestones. The National Ignition Facility (NIF) in the United States remains the only laboratory to have demonstrated a fusion energy gain factor above one, though efficiencies orders of magnitude higher are required to reach engineering breakeven. Meanwhile, Commonwealth Fusion Systems' SPARC tokamak project aims to achieve net energy gain by 2027, with assembly about 65% complete as of September 2025.

According to the F4E Fusion Observatory report, cumulative global funding increased from €9.9 billion to €13 billion (approximately $11.6 billion to $15.17 billion) between June and September 2025 alone. This rapid growth demonstrates how research breakthroughs are translating into investor confidence.

Roadmap to Demonstrator Plants

The U.S. Department of Energy introduced a new Fusion Science & Technology Roadmap on October 16, 2025, as part of a national 'Build–Innovate–Grow' strategy to commercialize fusion energy by the mid-2030s. The roadmap aims to bridge critical gaps in materials, plasma systems, fuel cycles, and plant engineering needed to build a fusion pilot plant.

'This roadmap represents our clearest path yet to commercial fusion power,' stated Energy Secretary Michael Johnson. 'By focusing on six core areas—structural materials, plasma-facing components, confinement systems, fuel cycle, blankets, and plant engineering—we're addressing the fundamental challenges that have held fusion back for decades.'

A notable innovation in the roadmap is the creation of an 'AI-Fusion Digital Convergence Platform' to accelerate commercialization through artificial intelligence and high-performance computing. The strategy aligns with President Trump's 'Unleashing American Energy' executive order and builds on previous DOE-FES plans while adding stronger AI integration.

Global Competition and Government Support

The global fusion race has become increasingly competitive, with China emerging as a dominant force. While the U.S. has dramatically reduced fusion funding from $1.48 billion in FY2024 to just $134 million in FY2025, China is investing an estimated $3 billion annually in government funding and potentially $5 billion in private funding. The UK has committed £2.5 billion ($3.37 billion) over five years for its STEP program.

'The funding landscape reveals stark contrasts between nations,' observed Dr. James Chen, director of the International Fusion Research Council. 'While the U.S. uses a venture-led approach, China employs a top-down strategy with public-private initiatives, and the EU utilizes a mix of public, private, and public-private funding. Each model has its strengths, but the scale of Chinese investment is particularly noteworthy.'

Challenges and Future Outlook

Despite the funding surge, challenges remain. According to the Fusion Industry Association's fifth annual Global Fusion Industry Report, 83% of companies still consider investment a major challenge, estimating they need a total of $77 billion to bring pilot plants online. The industry employs 4,607 people directly and supports at least 9,300 supply chain jobs, with employment quadrupling since 2021.

Most companies (84%) believe fusion-generated electricity will reach the grid before 2040, with 53% targeting 2035. 'We're at a pivotal moment,' said Sarah Thompson, CEO of Fusion Forward Ventures. 'The funding rounds of 2025 demonstrate that investors are betting on fusion's commercial future. Now we need to deliver on the promise of clean, abundant energy.'

The U.S. Department of Energy's Milestone-Based Fusion Development Program has also opened to new applicants, offering $10 million for new participants and $15 million for capability enhancements. The original eight companies selected in 2023 have raised over $350 million since the initial $46 million DOE investment, demonstrating how government support can catalyze private investment.

As fusion research advances toward demonstrator plants, the funding landscape of 2025 suggests that the long-awaited dream of commercial fusion power may be closer than ever before. With strategic roadmaps in place and unprecedented investor backing, the fusion industry appears poised to make significant strides toward delivering clean, sustainable energy to the global grid.

Nederlands

Nederlands

English

English

Deutsch

Deutsch

Français

Français

Español

Español

Português

Português