Fusion Energy's Public-Private Revolution Accelerates

The race to commercial fusion energy has entered a critical new phase in 2025, with unprecedented private sector partnerships and funding driving ambitious timelines for demonstration reactors. What was once the domain of massive government projects like ITER is now being transformed by nimble startups backed by billions in venture capital, all seeking to prove that fusion power can move from scientific breakthrough to practical electricity generation within this decade.

Billions in Private Investment Meet Government Roadmaps

According to recent investment analysis, the fusion energy sector has attracted over $1.7 billion in private funding through Q3 2025, with projections suggesting the year could close with $2.2 billion in total private investment. This comes alongside significant government initiatives, including the U.S. Department of Energy's recently released Fusion Science & Technology Roadmap that outlines a strategic path to commercialization.

Industry leaders are now pushing for even greater public-private collaboration. 'Despite over $6 billion in private venture capital, the massive infrastructure and materials science requirements demand a national effort comparable to the space race,' explains one industry analyst. 'We need public-private partnerships similar to the CHIPS and Science Act, where the government acts as a strategic investor to de-risk the final leap to net energy gain demonstration for electricity production.'

Leading Companies and Their Approaches

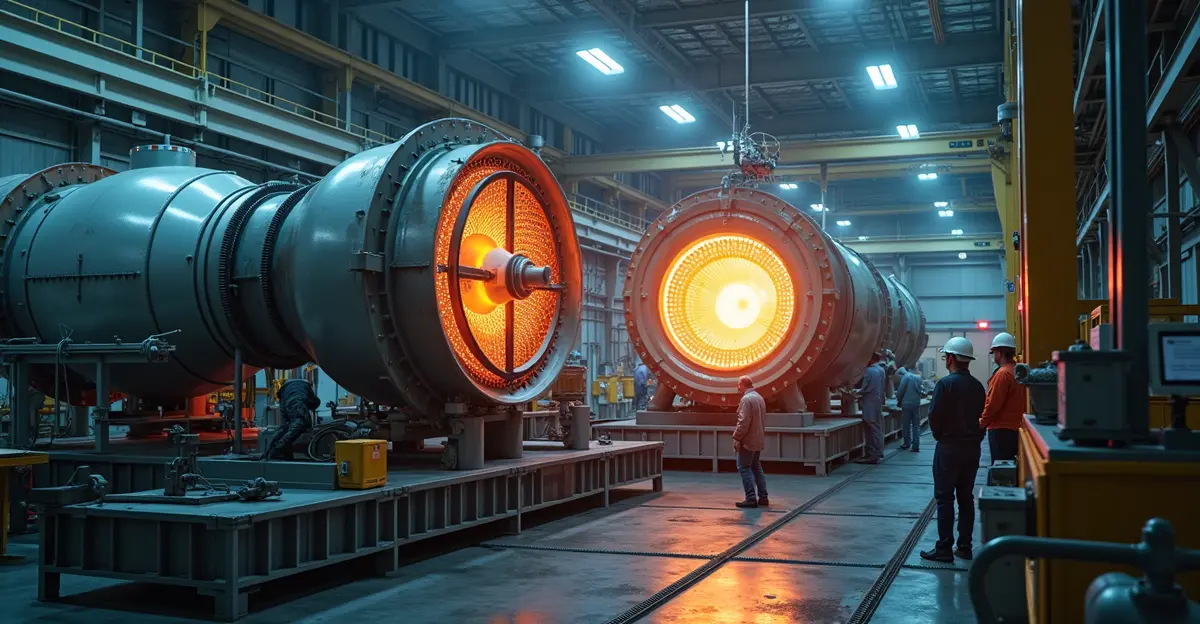

Three companies stand at the forefront of this fusion revolution. Commonwealth Fusion Systems (CFS) has raised over $2 billion and is developing the SPARC compact tokamak reactor using high-temperature superconducting magnets, aiming for net energy gain by 2025 and commercial power plants in the early 2030s. Their approach builds on decades of tokamak research but uses new magnet technology to create smaller, more efficient reactors.

TAE Technologies has secured over $1.2 billion and focuses on Field-Reversed Configuration technology using hydrogen-boron fuel to minimize radioactive waste, with its Copernicus reactor expected to operate by 2025. Meanwhile, Helion Energy has raised over $1 billion and uses Magneto-Inertial Fusion technology, having signed a landmark agreement with Microsoft to deliver at least 50 megawatts of fusion-generated electricity by 2028.

Government Programs Opening Doors

The U.S. Department of Energy has responded to this private sector momentum with concrete programs. In June 2025, the DOE's Office of Fusion Energy Sciences opened its Milestone-Based Fusion Development Program to new private companies and teams, with $10 million available for new awardees and $15 million for capability enhancements. This fast-tracked opportunity comes as the original eight companies selected in 2023 have raised over $350 million since the initial $46 million DOE investment.

'The program now seeks to expand representation in the growing private fusion sector, which includes diverse confinement approaches like inertial confinement, magnetic confinement, and innovative concepts,' notes a DOE spokesperson. New awards will be technology investment agreements requiring at least 50% cost coverage by recipients, with payments made only upon milestone completion.

The Global Landscape and Competitive Pressures

While the U.S. private sector is surging ahead, the global picture reveals stark contrasts in government support. The U.S. has dramatically reduced fusion funding from $1.48 billion in FY2024 to just $134 million in FY2025, while the UK committed £2.5 billion ($3.37 billion) over five years for its STEP program. Most notably, China emerges as the dominant force, investing an estimated $3 billion annually in government funding and potentially $5 billion in private funding.

This international competition adds urgency to the public-private partnership discussions. 'China is positioning itself as the global leader in fusion energy development with ambitious construction projects and workforce development plans,' warns a policy expert. 'The U.S. risks falling behind in what could be the most important energy technology of the 21st century if we don't match this commitment.'

Technical Challenges and Timeline Realities

Despite the enthusiasm and funding, significant technical hurdles remain. As noted in fusion power research, achieving sustained energy gain beyond breakeven and converting it efficiently into electricity remain major challenges. The process generates intense neutron radiation that gradually damages reactor walls, and tritium fuel remains scarce on Earth with a half-life of about 12.3 years.

Different companies are tackling these problems with varied approaches. Some focus on alternative fuels like hydrogen-boron that produce fewer neutrons, while others are developing advanced materials that can withstand decades of neutron bombardment. The diversity of approaches is seen as a strength, with multiple paths being explored simultaneously.

The Path Forward to Demonstration Reactors

The ultimate goal for all these partnerships is clear: building demonstration reactors that prove fusion can generate electricity reliably and economically. Most companies are targeting the late 2020s to early 2030s for their first pilot plants, with commercial deployment envisioned for the 2030s.

The success of these efforts could transform global energy systems. Fusion offers the promise of abundant, carbon-free electricity with minimal radioactive waste compared to fission reactors. As one industry CEO puts it: 'We're not just building power plants—we're building the foundation for a completely new energy economy. The partnerships we're forming today between private companies, government agencies, and research institutions will determine whether fusion becomes a reality in our lifetimes.'

With billions in private investment, evolving government support, and aggressive timelines, 2025 marks a pivotal moment in the decades-long quest for practical fusion energy. The coming years will reveal whether these public-private partnerships can overcome the remaining scientific and engineering challenges to deliver on fusion's long-promised potential.

Nederlands

Nederlands

English

English

Deutsch

Deutsch

Français

Français

Español

Español

Português

Português