Fusion Funding and Research Momentum Reaches Critical Mass

The race to commercialize fusion energy has entered a new phase of unprecedented momentum, driven by a powerful combination of public investment and private sector innovation. With over $15 billion in cumulative funding now flowing into the sector and a clear roadmap for commercialization by the mid-2030s, what was once considered a distant scientific dream is rapidly becoming an industrial reality.

The Public-Private Partnership Revolution

In October 2025, the U.S. Department of Energy released its comprehensive Fusion Science and Technology Roadmap, marking a watershed moment for the industry. Developed with input from over 600 scientists, engineers, and industry stakeholders, this 52-page strategy outlines a coordinated national approach to accelerate fusion energy development. 'This roadmap represents the most significant alignment of public and private efforts in fusion history,' says Dr. Sofia Martinez, a leading fusion researcher. 'We're moving from isolated experiments to a coordinated industrial ecosystem.'

The roadmap adopts a three-pronged 'Build-Innovate-Grow' strategy: building critical infrastructure for testing, innovating through industry-informed research, and growing the U.S. fusion ecosystem both nationally and internationally. This approach recognizes that while private companies have made remarkable progress, government support remains essential for developing the foundational infrastructure and research that individual companies cannot afford to build alone.

Private Investment Milestones

The private sector has responded with extraordinary enthusiasm. According to recent data, fusion startups attracted record investment in 2025, with the top 10 companies alone securing billions in funding. Commonwealth Fusion Systems leads the pack with $2.9 billion in total funding, followed by TAE Technologies ($1.5 billion) and Helion Energy ($1 billion). These companies represent diverse technological approaches, from tokamaks and stellarators to Z-pinch and inertial confinement methods.

'What we're seeing is a fundamental shift from science project to serious energy business,' notes an industry analyst from StartupWired. 'Investors are no longer betting on whether fusion is possible, but on which company will commercialize it first.' The industry now employs over 5,000 people directly, with supply chain development reaching $543 million in 2026.

Commercialization Roadmaps and Timelines

The DOE roadmap establishes clear timelines: short-term goals (2-3 years) focus on developing critical infrastructure and AI-powered digital platforms; medium-term objectives (3-5 years) target transformative research breakthroughs; and long-term goals (5-10 years) aim for grid-connected fusion power by the mid-2030s. This structured approach provides both clarity for investors and coordination for researchers.

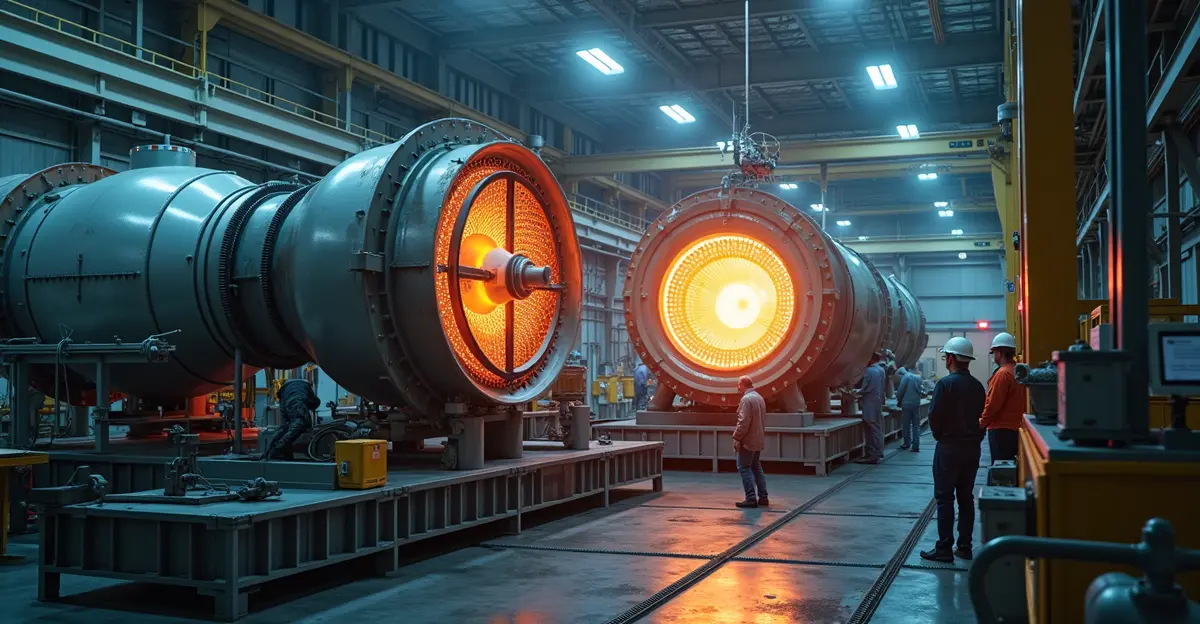

Key technical challenges being addressed include structural materials that can withstand intense neutron radiation, plasma-facing components, confinement systems, fuel cycles, breeding blankets, and plant engineering. Artificial intelligence is playing an increasingly crucial role, with companies using machine learning to optimize plasma stability and materials discovery.

Global Competition and Collaboration

While the U.S. is taking a leadership position, international competition and collaboration are intensifying. The ITER project in France continues as the world's largest fusion experiment, while countries like the UK, China, Japan, and Germany are advancing their own programs. However, the private sector's agility and focus on commercialization are creating a new dynamic in the global fusion landscape.

'The public-private model is proving incredibly effective,' says Martinez. 'Government provides the foundational research and infrastructure, while private companies drive innovation and commercialization at unprecedented speed.' This synergy is particularly evident in areas like high-performance computing, where partnerships between fusion companies and tech giants like NVIDIA are creating 'digital twins' of fusion machines to accelerate development.

Challenges and Opportunities Ahead

Despite the remarkable progress, significant challenges remain. Tritium fuel supply, materials durability under extreme conditions, and economic viability are still major hurdles. The roadmap addresses these through targeted research initiatives and infrastructure development, including plans for a Fusion Pilot Plant that would demonstrate net electricity production.

The potential rewards, however, are enormous. Fusion offers the promise of abundant, carbon-free energy with minimal radioactive waste and inherent safety advantages over traditional nuclear fission. As the industry transitions from scientific research to industrial relevance, the coming years will be critical in determining whether fusion can deliver on its long-standing promise of clean, limitless energy.

With coordinated public-private efforts, clear commercialization roadmaps, and unprecedented investment momentum, the fusion energy sector appears poised for a breakthrough decade that could fundamentally transform global energy systems.

Nederlands

Nederlands

English

English

Deutsch

Deutsch

Français

Français

Español

Español

Português

Português