Global Memory Shortage Hits Consumers as AI Dominates Chip Production

The artificial intelligence revolution is creating an unexpected crisis for everyday technology consumers. As memory manufacturers shift production to meet explosive demand for AI infrastructure, conventional DRAM and NAND flash memory for consumer electronics is becoming scarce and expensive. This strategic reallocation is causing what industry analysts describe as an 'unprecedented' price surge that could reshape the tech landscape through 2026 and beyond.

The AI-Driven Supply Squeeze

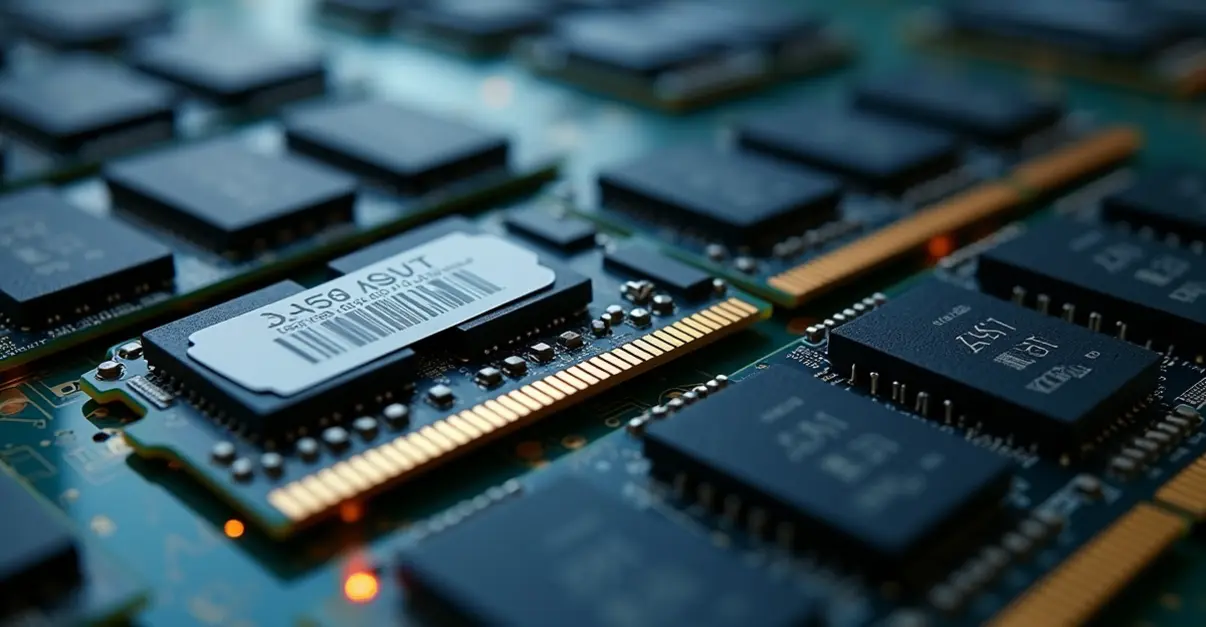

Memory manufacturers including Samsung Electronics, SK Hynix, and Micron Technology are prioritizing high-bandwidth memory (HBM) production for AI accelerators and data center GPUs over conventional memory for PCs, smartphones, and other consumer devices. According to industry analysis, HBM manufacturing requires significantly more wafer capacity per bit than standard DRAM modules, creating a zero-sum game for production resources.

'We've never witnessed costs escalating at the current pace,' said Dell Technologies Chief Operating Officer Jeff Clarke during a November 2025 analyst call, describing tighter availability across DRAM, hard drives, and NAND flash memory.

The numbers are staggering: DRAM contract prices are forecast to jump 55-60% in Q1 2026, while NAND flash prices increased by 246% throughout 2025. This represents a fundamental shift in the semiconductor market, where memory has traditionally been an abundant, low-cost component.

Consumer Impact and Market Response

The memory crunch is forcing PC manufacturers to raise retail prices by 15-20% and downgrade entry-level configurations. Smartphones, tablets, smart TVs, routers, and other electronics are also affected as memory becomes the constraint rather than an abundant component.

'The cost surge is unprecedented,' disclosed Lenovo Chief Financial Officer Winston Cheng, noting that the company's memory inventories were approximately 50% above normal levels in anticipation of continued shortages.

According to Forbes analysis, consumers are advised to prioritize configurations with sufficient RAM and storage upfront when purchasing new devices, as upgrading later may be even more expensive. The memory now accounts for about 20% of laptop hardware costs, up from 10-18% in early 2025.

Geopolitical Factors and Long-Term Outlook

The supply chain is further constrained by escalating trade tensions between the United States and China. Throughout 2025, fears of U.S. regulatory backlash and new tariff structures led major manufacturers to halt sales of older semiconductor manufacturing equipment to Chinese entities, effectively capping production capacity in the region.

As reported by CNBC, the 'memory wall' phenomenon is emerging where AI processors wait for data due to insufficient memory speed, highlighting the critical nature of this component in the AI era.

Industry experts predict the memory crunch could persist until 2027 or later, fundamentally reshaping how devices are priced and configured. Large vendors with supply chain resilience and vertical integration, like Apple, are better positioned than smaller manufacturers who face particular pressure due to thin margins.

The crisis represents a significant challenge for the tech industry's democratization efforts, potentially reversing years of progress in making advanced technology accessible to broader markets.

Nederlands

Nederlands

English

English

Deutsch

Deutsch

Français

Français

Español

Español

Português

Português