Federal Reserve Announces Major Policy Framework Revisions

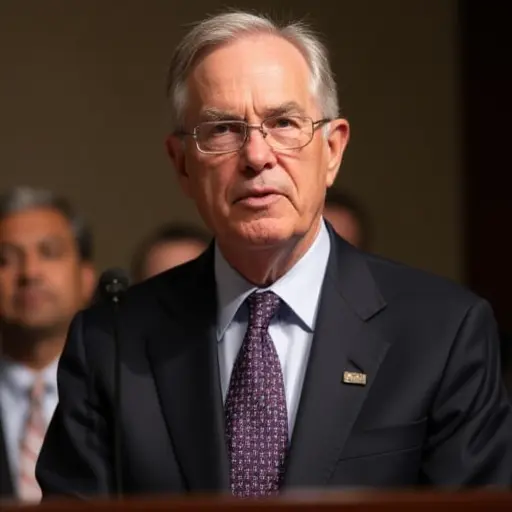

Federal Reserve Chair Jerome Powell unveiled significant changes to the central bank's monetary policy framework during his highly anticipated speech at the Jackson Hole Economic Symposium on August 22, 2025. The revised Statement on Longer-Run Goals and Monetary Policy Strategy represents the culmination of the Fed's second public review of its policy framework, conducted every five years.

Key Changes to Monetary Policy Approach

The most notable change involves abandoning the "makeup" strategy adopted in 2020, which had emphasized the risks of the effective lower bound (ELB) on interest rates. The new framework returns to flexible inflation targeting while removing language that focused specifically on ELB constraints. Powell emphasized that the revised strategy is designed to "promote maximum employment and stable prices across a broad range of economic conditions."

The Fed also eliminated the controversial "shortfalls" terminology from its maximum employment guidance. Instead, the new statement clarifies that "the Committee recognizes that employment may at times run above real-time assessments of maximum employment without necessarily creating risks to price stability." This change addresses communication challenges that emerged during the post-pandemic recovery period.

Current Economic Context

Powell's speech came amid a complex economic environment characterized by slowing job growth, elevated inflation, and significant policy changes affecting trade and immigration. The July employment report showed payroll growth slowing to just 35,000 jobs per month over the past three months, down from 168,000 monthly in 2024.

Inflation remains above target, with total PCE prices rising 2.6% over the 12 months ending in July, while core PCE inflation reached 2.9%. The Fed Chair noted that tariff increases are beginning to affect consumer prices, creating additional inflationary pressures that the central bank must monitor carefully.

Dual Mandate Balancing Act

The revised framework emphasizes the Fed's commitment to both sides of its dual mandate—maximum employment and price stability. Powell stressed that "price stability is essential for a sound and stable economy and supports the well-being of all Americans," while also highlighting the importance of "durably achieving maximum employment fosters broad-based economic opportunities and benefits for all Americans."

The new consensus statement maintains the 2% inflation target as most consistent with the Fed's dual-mandate goals and reaffirms the commitment to conduct public reviews every five years to ensure the framework evolves with changing economic conditions.

Nederlands

Nederlands

English

English

Deutsch

Deutsch

Français

Français

Español

Español

Português

Português