Federal Reserve Chair Powell faces stagflation dilemma with high inflation and stagnant growth, avoiding the term while signaling focus on labor market over inflation control.

Federal Reserve in Challenging Position as Economic Growth Stalls

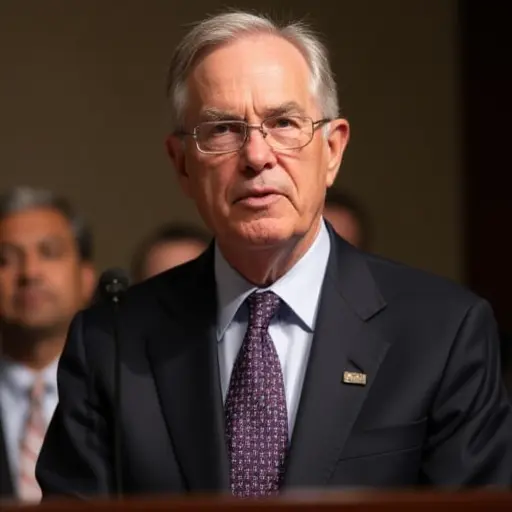

Federal Reserve Chair Jerome Powell finds himself navigating treacherous economic waters following the central bank's recent interest rate decision. While the Fed lowered rates, Powell emphasized this doesn't signal the beginning of a prolonged easing cycle. 'He spoke of a "challenging situation," meaning the Fed is in a place where no central banker ever wants to be,' says macroeconomist Edin Mujagic.

The Stagflation Conundrum

The United States economy faces a perfect storm of economic challenges. On one hand, inflation remains stubbornly high, with the consumer price index hovering around 3% - significantly above the Fed's 2% target. Compounding this issue, the US dollar has depreciated approximately 15% since the beginning of 2025, creating additional inflationary pressures for the coming year.

Meanwhile, economic growth has stagnated, creating what economists describe as stagflation - the simultaneous occurrence of stagnant economic growth and high inflation. This represents a significant departure from the previous five years, when the Fed could focus primarily on inflation control while the economy continued to expand robustly.

Political Pressure Complicates Decision-Making

The Fed's challenges extend beyond pure economics. The central bank faces increasing political pressure from the White House, which has been actively attempting to influence monetary policy decisions. This political dimension adds another layer of complexity to an already difficult balancing act between supporting employment and controlling inflation.

According to the https://www.federalreserve.gov, the Fed's dual mandate requires it to pursue maximum employment and price stability. However, these objectives currently demand contradictory policy approaches, forcing the central bank to prioritize one over the other.

Market Implications and Future Outlook

Powell's careful avoidance of the term "stagflation" during his speech signals the Fed's cautious approach to managing market expectations. Investors should prepare for continued volatility as the central bank navigates these competing priorities. The Fed's shift toward greater focus on the labor market suggests inflation may remain elevated for the foreseeable future, potentially impacting investment returns across various asset classes.

As the situation evolves, market participants will closely monitor upcoming economic data releases and Fed communications for clues about future policy direction. The central bank's ability to successfully manage this delicate balancing act will have significant implications for both domestic and global economic stability.

Nederlands

Nederlands

English

English

Français

Français

Deutsch

Deutsch

Español

Español

Português

Português