Crypto Market Sees Deep Red as Bitcoin Tests Crucial Support

The cryptocurrency market is experiencing one of its most significant downturns in recent months, with Bitcoin trading at critical support levels that could determine the next major price movement. According to market data, the total cryptocurrency market capitalization has dropped to approximately $2.54 trillion, representing a daily decline of over 4% and continuing a bearish trend that began in late 2025.

Bitcoin's Precarious Position

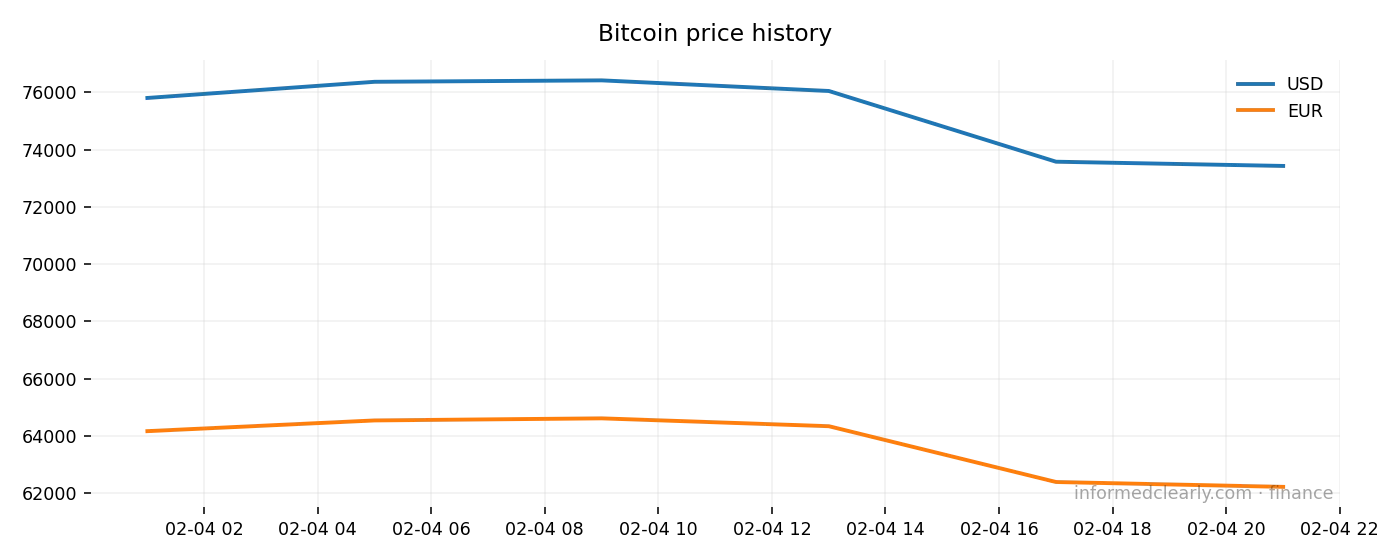

Bitcoin, the leading cryptocurrency, is currently trading around $74,500, having lost 4.6% in the past 24 hours and nearly 17% over the past week. The digital asset is now testing the psychologically important $70,000 support level, which analysts consider crucial for determining whether the market will find a bottom or continue its descent.

Analyst Nic Puckrin has provided detailed technical analysis of the situation, noting that Bitcoin has broken through multiple key technical levels in recent months. 'Where is the Bitcoin Bottom? Ever since breaking the 50w MA bull trend in November, Bitcoin's momentum has been to the downside,' Puckrin stated in a social media analysis. 'We're currently trading around the April low of $74,400. The $70,000 level is the next critical support.'

Market-Wide Bloodbath

The downturn isn't limited to Bitcoin. Ethereum, the second-largest cryptocurrency, has fallen to $2,166, representing a 6% daily decline and a staggering 29% weekly loss. Solana has been hit even harder, dropping 9% in the past 24 hours and leading the declines among top-ten cryptocurrencies.

According to market analysis, 64 of the top 100 cryptocurrencies posted losses on February 4, 2026, with the overall market sentiment deteriorating sharply. The Crypto Fear and Greed Index has plunged to around 15 points, indicating 'extreme fear' among investors.

Technical Breakdown and Potential Scenarios

Technical analysts point to several concerning developments. Bitcoin has broken below three critical support levels: the Fourth Halving AVWAP ($85,257), the All-Time High AVWAP ($97,616), and the weekly SMA50 ($100,415). These levels, which previously served as support during 2025 pullbacks, have now flipped to resistance, suggesting sellers have taken control of the market.

Puckrin's analysis suggests that if Bitcoin breaks below the $70,000 support level, the next potential bottom could lie between $55,700 and $58,200. 'That would be the bottom,' he predicts, based on the intersection of historical price anchors including the average purchase price of all coins and long-term moving averages.

Institutional Factors and Market Sentiment

The current downturn follows significant institutional outflows from spot Bitcoin ETFs, which have seen billions in monthly outflows since October 2025. According to CNBC analysis, the decline is attributed to multiple factors including expectations of a more hawkish Federal Reserve stance, slowing regulatory momentum for digital assets, and decreased consumer adoption of cryptocurrencies in the U.S.

Despite the bearish sentiment, some institutional players continue to accumulate. MicroStrategy recently purchased 855 BTC on February 2, maintaining its position as the world's largest publicly traded Bitcoin holder with 713,502 BTC worth over $52 billion.

Historical Context and Future Outlook

The current market conditions echo previous cryptocurrency cycles. According to historical data, Bitcoin reached its last all-time high of $125,835.92 in October 2025, and has since declined approximately 40% from that peak. This pattern resembles previous boom-bust cycles in cryptocurrency history, including the 2018 crash when Bitcoin fell 80% from its peak.

Market participants are closely watching the $70,000 level, with many analysts suggesting that a break below this support could trigger further declines. However, some technical indicators suggest that February has historically been Bitcoin's strongest month with average returns of 14.3%, potentially offering hope for a recovery if historical patterns hold.

Nederlands

Nederlands

English

English

Deutsch

Deutsch

Français

Français

Español

Español

Português

Português