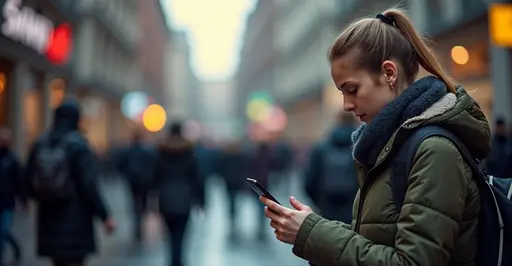

A New Generation Enters Financial Markets

Young people across Germany are increasingly turning to mobile stock trading apps, reshaping the investment landscape. Fueled by commission-free platforms and social media influence, this digital-savvy generation is entering financial markets earlier than any previous cohort. According to recent data from BaFin (Germany's Federal Financial Supervisory Authority), users under 25 on platforms like Trade Republic and Scalable Capital have increased by 120% since 2023.

The App Revolution

Neo-brokers have democratized investing with user-friendly interfaces and fractional shares. Trade Republic, Germany's leading trading app, now boasts over 4 million users, with 38% aged 18-25. "We've removed traditional barriers like high fees and complex processes," explains CEO Christian Hecker. "Young investors can start with just €1 and learn through intuitive tools."

Social Media Influence

Financial influencers (#FinTok) on TikTok and Instagram have accelerated this trend. Content tagged #Aktien (stocks) and #Investieren has garnered over 500 million views in German-speaking regions. Munich student Lena Weber (19) shares: "I started with €50 after watching explainer videos. Now I regularly invest part of my part-time job income."

Education Gap Concerns

Despite the boom, financial literacy remains a challenge. A 2025 Deutsche Bank study revealed only 32% of young investors understand basic concepts like diversification. BaFin has responded with mandatory risk warnings and educational initiatives. "We encourage responsible investing, not gambling," emphasizes BaFin president Mark Branson.

Market Impact

This youth movement is influencing market trends:

- Increased interest in ESG (Environmental, Social, Governance) investments

- Growth of "theme investing" in tech and renewable energy

- Higher volatility in small-cap stocks favored by young traders

Looking Ahead

As this generation matures, experts predict long-term market transformation. Commerzbank analyst Matthias Holweg notes: "They're developing lifelong investing habits. This could shift Germany's savings culture from traditional banks to capital markets." With continuous app innovation and financial education improvements, Germany's youth investing trend shows no signs of slowing.

Nederlands

Nederlands English

English Français

Français Deutsch

Deutsch Español

Español Português

Português