Bitcoin Soars as Trump's Policies Fuel Crypto Boom

Bitcoin reached a record high of $124,000 on Thursday, continuing its unprecedented rally. Financial experts attribute this surge to President Trump's cryptocurrency-friendly policies in the United States, warning these developments could potentially trigger a new credit crisis.

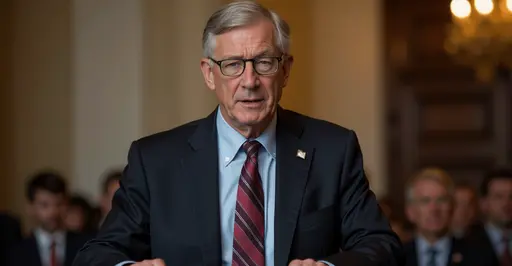

The Crypto President's Agenda

President Trump, self-dubbed the 'crypto president,' has championed legislation reducing oversight of digital currencies. The recent Congressional approval of stablecoin regulations - cryptocurrencies pegged to stable assets like the US dollar - aims to minimize volatility and integrate crypto into mainstream finance.

Global Banking Divide

While US financial institutions increasingly invest in cryptocurrencies, Dutch banks remain cautious. ING, Netherlands' largest bank, confirmed it currently prohibits cryptocurrency investments through its platforms, citing excessive volatility as the primary risk factor.

Bubble Formation Concerns

"Growing investor confidence is inflating a crypto bubble," stated Annelieke Mooij, public law lecturer at Tilburg University. "The critical question is whether it will burst abruptly or gradually." Experts draw parallels to the 2008 financial crisis, where complex, poorly understood financial products contributed to market collapse.

European Safeguards

Europe maintains stricter cryptocurrency regulations protecting against fraud and money laundering. While these measures strengthen EU banks, experts caution that global crypto markets remain interconnected. Dennis Post of EY noted: "Transparency deficiencies in US crypto markets resemble pre-2008 conditions where misunderstood products caused systemic failures."

Though no immediate crisis indicators exist, Trump's policies heighten systemic risks. European regulations may mitigate but not prevent potential fallout from US market disruptions.

Nederlands

Nederlands

English

English

French

French

Deutsch

Deutsch

Espaniol

Espaniol

Portugese

Portugese