Federal Reserve cuts interest rates by 25 basis points to 4-4.25% amid Trump pressure and labor market concerns, maintaining institutional independence while addressing economic weakness.

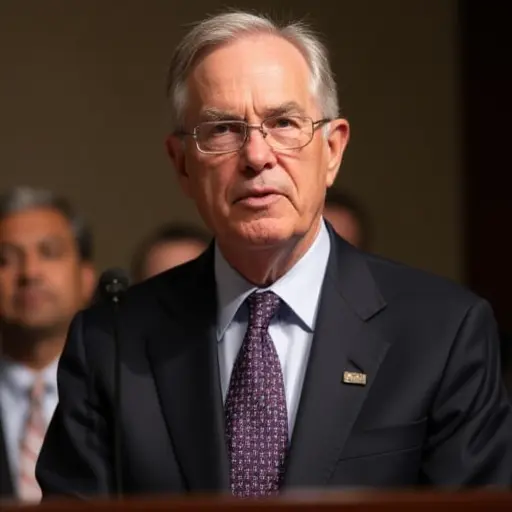

Federal Reserve Lowers Rates Despite Political Pressure

The Federal Reserve has announced a 25 basis point interest rate cut, bringing the federal funds rate to a range of 4% to 4.25%. This marks the first rate reduction since President Donald Trump's re-election and comes after months of intense political pressure from the White House.

Political Interference and Institutional Independence

The decision unfolds against a backdrop of unprecedented political interference in monetary policy. President Trump has repeatedly attacked Fed Chair Jerome Powell and attempted to replace Fed board members who opposed his demands for deeper rate cuts. "The Fed must remain independent from political pressure to maintain credibility in financial markets," stated an anonymous Fed official.

Economic Context and Inflation Concerns

The Fed faces a delicate balancing act between cooling inflation and supporting economic growth. While inflation has moderated from its peak of over 7% two years ago, it remains stubbornly around 2.5% - above the Fed's 2% target. The central bank is particularly concerned about the inflationary impact of Trump's import tariffs and tax policies.

Labor Market Weakness Drives Decision

Recent labor market data showing weaker-than-expected job growth provided the primary justification for the rate cut. Employment figures have been repeatedly revised downward since June, indicating a softening labor market that concerns policymakers.

The Fed's decision reflects careful consideration of both economic fundamentals and the need to maintain institutional independence amid political pressure. Further rate cuts are anticipated in coming months as the central bank monitors economic developments.

Nederlands

Nederlands English

English Français

Français Deutsch

Deutsch Español

Español Português

Português